Energy prices are going through the roof. There has never been a better time for businesses, including service stations to invest in solar. The six points below will tell you why.

1. Protection against rising costs

Energy prices have just hit an all time high in Australia. As a result, the cost of not going solar for small and medium businesses is higher than ever.

2. Produce more of your own energy

Unlike a lot of businesses, service stations operate seven days a week. This means that the free energy generated from your roof will offset much more of its electricity costs, delivering greater savings. Solar will typically contribute to between 30 – 40% of your sites energy needs.

3. Government subsidies

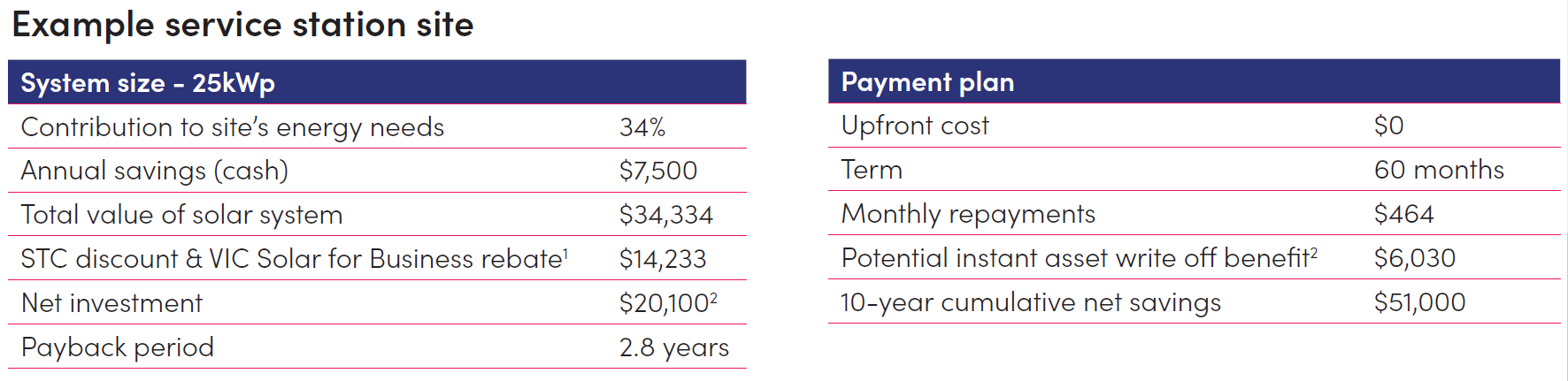

There are significant federal and state government incentives to invest in solar now. These include small-scale technology certificates (STCs) and the Victorian Government’s Solar Business Program, which could offset up to 60% off your solar investment.

4. Tax incentives

Your business could be eligible for the Federal Government’s instant asset tax write off if you invest in solar before 30 June 2023. This allows eligible businesses to claim an immediate tax deduction for investing in certain business equipment, including a new solar PV system.

5. Fast payback or immediate savings

The payback period for solar is as fast as three years right now! However, there are also ways where you can invest in solar with $0 upfront cost. This is achieved through a payment plan, where the energy savings exceed the monthly finance payments, providing an immediate cash flow benefit.

6. Future proof your business

With the demand for electric vehicles accelerating and charging stations being rolled out, this will mean higher energy demand for your site. Solar is a great way to offset these changes.

1. More details on the Victorian Government’s Solar for Business Program can be found here https://www.solar.vic.gov.au/solar-business-program.

2. Assumes company tax rate 30%.

Instant Asset Tax Write Off information – https://www.ato.gov.au/Business/Depreciation-and-capital-expenses-and-allowances/Simpler-depreciation-for-small-business/Instant-asset-write-off/?=redirected_instantassetwriteoff